About Banking

Wiki Article

Fascination About Bank Definition

Table of ContentsFascination About Bank AccountThe Basic Principles Of Bank Reconciliation The 9-Second Trick For BankSome Known Factual Statements About Bank Definition

You can also conserve your cash as well as earn rate of interest on your financial investment. The cash stored in a lot of checking account is government guaranteed by the Federal Down Payment Insurance Coverage Company (FDIC), as much as a limitation of $250,000 for specific depositors as well as $500,000 for jointly held down payments. Banks also provide credit possibilities for individuals as well as corporations.

Financial institutions earn a profit by billing even more passion to borrowers than they pay on interest-bearing accounts. A bank's size is figured out by where it lies as well as who it servesfrom little, community-based establishments to huge business banks. According to the FDIC, there were simply over 4,200 FDIC-insured commercial banks in the United States as of 2021.

Benefit, interest rates, and also charges are some of the elements that assist consumers determine their chosen financial institutions.

Our Bank Certificate Ideas

banks came under extreme examination after the global financial situation of 2008. The governing setting for banks has actually since tightened up significantly consequently. United state financial institutions are managed at a state or nationwide level. Depending upon the structure, they may be controlled at both levels. State banks are managed by a state's division of banking or division of banks.

, for example, takes deposits as well as offers locally, which can provide a much more individualized financial partnership. Select a convenient location if you are picking a bank with a brick-and-mortar place.

The Single Strategy To Use For Bank Account Number

Some financial institutions likewise supply mobile phone apps, which can be beneficial. Some big banks are moving to finish over-limit fees in 2022, so that might be a crucial factor to consider.Finance & Growth, March 2012, Vol (bank). 49, No. 1 Institutions that match up savers and customers aid make certain that economic climates function smoothly YOU'VE got $1,000 you do not require for, claim, a year as well as want to make income from the cash until then. Or you desire to acquire a the original source home and also need to borrow $100,000 and also pay it back over thirty try this web-site years.

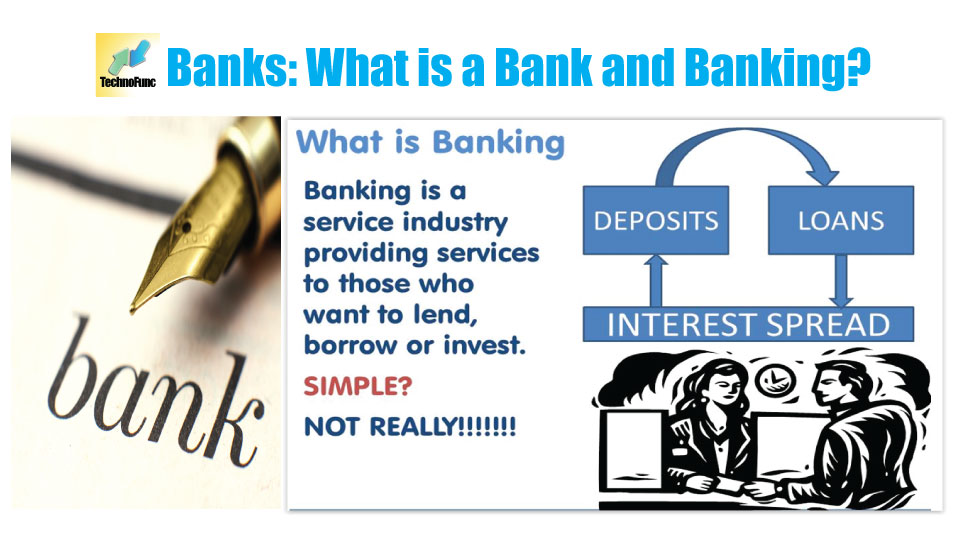

That's where banks can be found in. Although banks do numerous points, their main role is to take in fundscalled depositsfrom those with money, pool them, and also lend them to those who need funds. Financial institutions are middlemans between depositors (that provide cash to the bank) and consumers (to whom the bank provides money).

Down payments can be readily available on demand (a checking account, for instance) or with some limitations (such as cost savings and also time deposits). While at any type of provided moment some depositors need their cash, most do not.

The Buzz on Bank Account

The procedure includes maturity transformationconverting temporary obligations (deposits) to long-lasting possessions (lendings). Banks pay depositors much less than they obtain from borrowers, as well as that difference represent the bulk of financial institutions' earnings in many nations. Financial institutions can enhance conventional down payments as a source of financing by directly borrowing in the cash and also capital markets.

Banks maintain those called for reserves on down payment with reserve banks, such as the United State Federal Reserve, the Financial Institution of Japan, and the European Reserve Bank. Financial institutions produce cash when they offer the remainder of the money depositors provide them. This cash can be made use of to acquire goods and also services as well as can locate its means back into the financial system as a deposit in one more bank, which after that can offer a fraction of it.

The dimension of the multiplierthe amount of cash created from a preliminary depositdepends on the quantity of money banks should continue reserve (bank certificate). Banks also lend and reuse excess money within the financial system and create, distribute, as well as trade protections. Banks have a number of ways of earning money besides stealing the difference (or spread) in between the rate of interest they pay on deposits and borrowed cash and also the rate of interest they gather from customers More hints or safeties they hold.

Report this wiki page